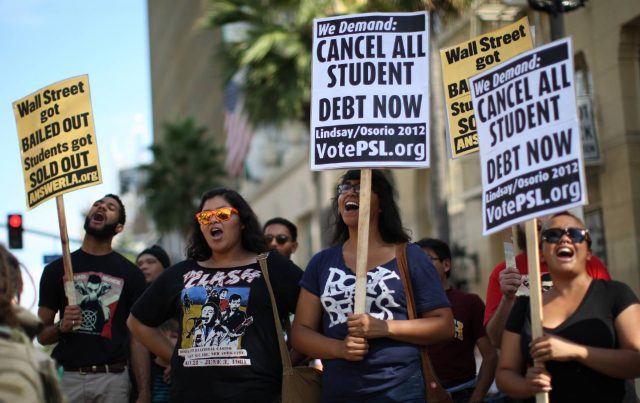

When you can’t pay your mortgage, they take the house. When you don’t pay your car loan, they take the car. Yet, when people buy a dubious degree at an inflated price from a questionable program, the left now argues that Americans should bail out the debtors and let them keep their degree. It’s absurd. Student debt cancellation requires degree cancelation. You can keep the knowledge; the degree goes back.

Why on earth would any University, most being revenue predators, want a degree back, you ask? Oh, they don’t. But any relief package could easily create a powerful incentive to force them to take back the degree and some number of credit hours in exchange for tuition reimbursement. I’ll lay it out for you below.

First, as anyone with a real degree knows, “incentives matter.” It’s a guiding principle of economics, as well as life. In fact, good public policy is aimed at creating incentives that reward good behavior, and likewise creating disincentives for bad behavior.

A terrible incentive would be to reward unscrupulous sellers (universities) and irresponsible buyers (students), by disconnecting them from a problem that is nearly entirely of their making, and then passing the cost (burden shifting) on to society as a whole.

The current leftwing solution to bad education investments and dishonest selling is to reward student debtors by punishing taxpayers: that includes people who didn’t or couldn’t go to college, people who went and paid, and people who decided not to go, seeking an entirely different set of skills … forcing all of these people to pay for debts for which they are not responsible. It’s literally ridiculous.

This type of “share-the-burden-and-eschew-the-responsibility” public policymaking has been the touchstone of altleft policies for decades. Disconnecting buyers from sellers, and removing the innovation, failure, success, and pain of markets is why, for example, our healthcare system is a disaster. Healthcare isn’t a failure of markets … it is a failure of market manipulation.

I didn’t make you go to a terrible university or study a program for which there is no job market. That’s on you and the education industry that sold you on such a folly. I didn’t make you borrow 150K for an out of state English degree when you could have gotten the same degree in-state, through community college and your own state school at an 1/8th of the price. You did that. Why would I be on the hook to pay for it?

I wrote an entire book on how the education industry has been creating a debtor class, and on how the industry works, scrubbing through society in search of revenues to pay for mediocre, permanent employees hawking dubious degrees and setting new standards for lack of innovation or productivity. My 2018 book, Of Serfs and Lords, lays it all out, and indeed gives some great solutions to the problems I identify. I like to say, spend the 27 bucks before you borrow 150K for that degree in glass blowing.

The current hot political topic is the idea that recent education debtors, as part of Covid19 relief, should have their student debt erased. No, they shouldn’t.

Instead of poor incentives, let’s create incentives that matter. Why not tackle the education industry and the real problem of debt and value by realigning the incentives, as well as being true to the outcomes that result from poor choices?

How do we get cash-starved universities to buy back degrees or credits they can’t resell? I mean, as my book points out, most universities are doing whatever they can to raise money, sell meaningless degrees and certificate programs, and eliminate quality standards to get their hands on money, the vast majority of which is guaranteed federal loans. Your government is subsidizing this entire mess already, and the result of a culture of “get any degree at any cost,” from institutions that do not have to downsize or rightsize, is an army of students with big debt and dubious degrees.

Student loan restructuring could remedy so many problems with simple changes to the incentives. If Congress required a degree or credit buy-back as a prerequisite to any university having access to students with government-backed loans, universities would begin the buy-back tomorrow. The overwhelming majority of institutions could not survive without students who borrow money from the federal government, or that is subsidized by the federal government.

Here’s the great side-benefit to this change in incentives for universities. They would have to cut programs that are dubious. Sure, some might first cut sports, unnecessary clubs, amenities, etc. The market would fix that. In the end, universities would have to look hard at programs that don’t really turn out readily employable graduates. That’s great. And what better way to get data on programs and institutions that the market found less desirable than when the educational consumer returns to sell back his or her degree and credits in glass-blowing, or other interesting but less employable subjects?

Still, the universities could reduce the cost of the buybacks by offering to buy-back only certain credits, leaving the seller without a degree, but with credits toward a degree. Degree sellers could take those credits and apply them toward a different field of study, or transfer to a better or different institution. This way, universities would see some repeat customers who now need salable degrees.

The possibilities are endless, with universities offering to exchange credits rather than cash in some instances. However it is done, the irresponsible buyers and sellers make the solution. Likewise, universities are not to be saddled with buying back room and board, or books, or additional living expenses. The end-user had to live somewhere, and eat, and spend his or her money as they saw fit. So, those who chose the “college lifestyle” packed with amenities and cash on hand, they eat that lifestyle debt. It would not be subject to repurchase.

However, degree credits would be subject to exchange or repurchase, in whole or in part. Like the person who had the home or car repossessed, the degree goes away. The knowledge remains and so does the experience. This is critical because while some institutions like to sell this notion of all education as being good and valuable, the truth is, it’s not. Moreover, the reality is that students go to college, overwhelmingly, to obtain a degree from an accredited institution. It is the degree that opens the door to jobs. If you want the money back for your degree, you ought not to keep the value of it.

In fact, if we want to find out how many people really want debt relief because their degree is valueless, require them to give it back. This will separate those who just want someone else to pay their debt load from those who have firmly established that the degree they bought has no market value for them.

Perhaps the most offensive idea of the student loan cancellation movement is this concept that the debtor keeps the degree and likewise is not made at all responsible for the choices. The degree cancellation program with credit exchanges o cash reimbursement fixes that, and it likewise isolates education debt from lifestyle and living debt.

No serious lawmaker could support canceling debt. The law already permits forbearance, and COVID-related forbearance extensions may be worth examining. Canceling your college debt because you just became “woke” enough to realize you were bamboozled by an industry in dire need of reform is completely out of the question.

Degree cancellation gives lawmakers a unique opportunity to provide legitimate relief options, but also to fundamentally remake a broken higher education system.

You know who will hate this idea? Universities. That will tell you it is on the right track.